POWER OF COMPOUNDING

Power of Compounding Compounding is such a wonderful tool to grow wealth with easy small investing. So, here we go, to learn about compound interest and how rich becomes richer

PERSONAL FINANCE BLOG

8/19/20255 min read

Compounding is such a wonderful tool to grow wealth with easy small investing. So, here we go, to learn about compound interest, how it works, how it is different from simple interest, how you can gain wealth by this compounding tool, how rich uses this tool to make their wealth grow over time.

Meaning of Compounding

Compounding is such a wonderful tool of growing your hard earned money in to wealth which take cares your life after your retirement. It grows slowly and with time it generates a hefty return on which you live your life on your terms, by following your hobbies, passion or going on vacations with your friends and family. Power of Compounding gives you the charge of your life.

Snowball Effect

Like a snow ball rolls down from a peak, getting bigger in size while reaching down, the same works as compounding. At first you have to make a small ball of ice (a small investment), then rolling it down from a peak (the investment time frame) it starts getting bigger (the return on your investment).

Small investment on regular intervals with a longer time period gives better returns.

Story of compounding

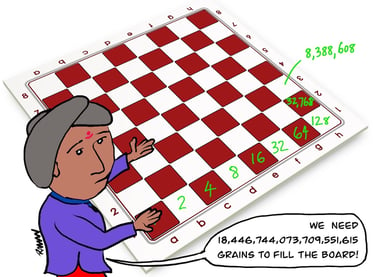

Once a poet delivering poems in a king’s palace, king and member of the king’s court enjoying his performance and praised him. In the honour, king decide it to give him some gold jewelry and coins, but he refused and said that to honour me just place a single grain of rice on first square of chessboard and double it for every square the amount of grain in last box is well rewarded.

The courtiers started placing the grains and double it for every square, so, what will you think, what will be the final amount of grains received by poet in last?

The answer is 18,446,744,073,709,551,615

Do u imagine the result will be this much large, this is because of compounding, single grain of rice with compounding reach to this amount. So likewise your regular investments can reach good returns with time. By the way your investments did not reach this level because for this, time frame is so long….

Difference between Simple and Compound Interest

Simple interest is calculated only on the principal amount, the amount you invested, while the compound interest is calculated on the principal amount and the interest you accumulated during previous periods.

That’s why compound interest works better than simple interest for accumulating wealth in longer time horizon. The longer you stay invested, the more compound interest works on the principal amount and previous interest.

Compound Interest Formula

where, A is the total amount, P is the principal, r is the rate of interest, n is the number of times interest is compounded per year, and t is the time in years

You look here two things are more important, the rate of interest and the time period you stay invested, you can gain high interest but high ROI brings high risk so give importance to investment time period. The longer you invested, longer time compounding works in your favour.

You learned this formula in your schooling some of you not remember this, and neither of you know the importance of this. This formula actually works in other areas of life also, like if you want to reduce weight look lean, the first day of workout does not change anything but if you consistently follows the routine you start looking changes in some days. Same way compounding works for money also, in the starting phase you notice no changes or negligible amount earned in interest but latter you will see the actual results.

Compound Interest Calculator

Here I am attaching a simple calculator of compound interest for you, put values and see how much you can save and invest to achieving your financial goals. But be realistic with this don’t put the values you can’t achieve.

Why you are not achieving wealth

The loan you take for short term spending on the desires, there you make the mistake of not gaining wealth. Borrowing with interest rate of 12-15% or some time 18-24% (for credit cards) annually you spend your hard earned money by giving interest to the lender for the amount you can save and invest.

Lets, say you take 2,00,000 loan for 2 year time frame with interest rate of 15% (1.25% monthly) you will pay monthly 9,697 and at the end you will pay 2,32,736. Here, you say to me I am just spending 32,736 more and I can get my desire fulfil by this extra amount.

But here's catch if you invested the same amount (9,697) for 2 year with the interest rate of 12% (that can be achievable) you will get 2,64,177 at the end of a year, you will get extra 64,177 amount with lesser interest rate, that you can spend on something else and your desire also fulfil.

So it’s better to track your spending and budget it accordingly, if you budget and invest, then you can achieve the desired amount and the extra interest also which helps you in your future.

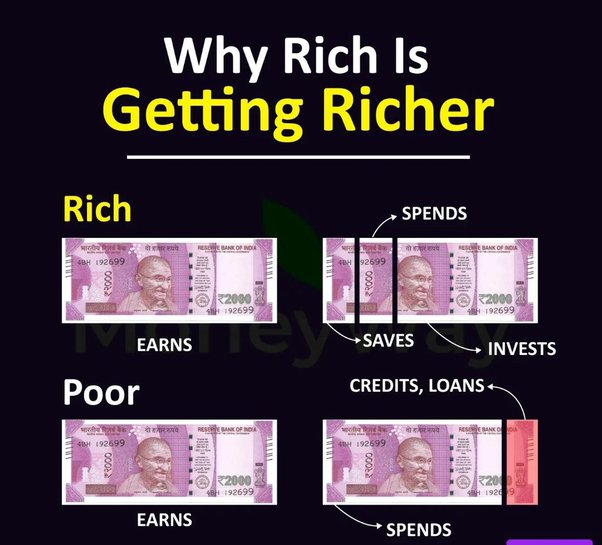

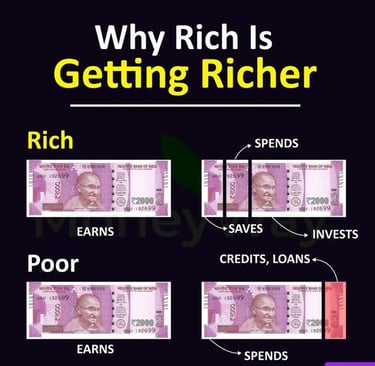

How rich becomes richer

You spend on liabilities and the richer invest to make assets which generates income for his/her monthly spending. Richer focuses on budgeting and investing, they invest early and compound interest works in their favour, and you invest in loans and liabilities, and compounding works against you. You are the only reason why you are not in good financial condition or not achieving your goals and dreams. So start budgeting and investing to get you dreams come true.

Thanks for reading the blog! I hope you enjoyed and gain some knowledge and find the blog valuable for you. Feel free to leave a comment that will inspire us to get more blogs like this.

Empowering you to manage your finances effectively.

Connect

© 2025. All rights reserved.